Murad Abdul Jalil | Zeynep Masri

Around an empty table devoid of the main course, carrying the same plates almost every day, sits a couple who has been living off the same food for days and forgot what it tastes like. Despite their suffering, they are thankful for having a roof over their heads, that spares them from paying the rent and mitigates some of “the economic burdens Syrian citizens deal with these days.”

“People are starving”, in these words Maryam, a 30-year-old young lady, who lives with her husband in Aleppo city held by the Syrian regime forces, described the dire economic situation her family and millions of Syrians face where most of them are on the brink of an economic collapse.

Despite nine years of war and its accumulated impacts on the Syrian economy where most sectors are damaged with a noticeable decrease in gross output, Syria’s current economic situation is unprecedented amid expectations of further deterioration.

In the light of the recurrent crises hitting the Syrian economy, Enab Baladi tries in this report to shed light on Syrians’ living conditions and the reasons behind these crises. It also discusses the impacts of the recent rift between prominent businessman Rami Makhlouf and senior figures close to the President of the Syrian regime Bashar al-Assad, on the Syrian economy.

Poverty in Syria

Painstaking attempts to live “at the minimum wage”

Attempting to monitor the impacts of the recent deterioration in the value of the Syrian pound, Enab Baladi contacted a large group of people residing in the regime-controlled areas, including some of those who recently moved to Turkey. Each of them has a different story, which is very similar to those of Syrians who mastered adapting themselves to crises in the past few years. However, they all agreed that nowadays living conditions are unprecedented.

Maryam and cooking

Maryam lives with her husband in their own house, which if it was not for it, they would have been in “dire straits” as she put it. Her husband, who works in a shop selling coffee beans in the center of Aleppo, earns SYP 12 thousand per week (USD 7 at an exchange rate of 1,714 per one dollar, according to the exchange rate of the third week of this month). His wage secures only a bread bundle, credit for his cell phone, along with paying fees of their generator subscription amid electricity shortage and a number of other basic food items that “neither nourishes nor avails against hunger.”

Maryam ( a nickname) talked about not cooking in her home, because of the prices’ hike by saying “I don’t cook in my house as the prices in Aleppo are beyond description”, with SYP 500 (USD 0.29) for a bread bundle, and another SYP 1,000 ( USD 0.58) for one kilogram of cheese, while one kilogram of tomatoes costs SYP 600 ( USD 0.35), additionally to few food items to spend their entire weekly wage.

This family tries to cover its living expenses and buy the necessary food items with a wage that does not exceed USD 30 a month, like many other Syrian families which have become “poor” with the sharp decline in the exchange rate of the Syrian pounds against the dollar reaching SYP 1,700 per one dollar.

Ali …his salary for rent and the rest on expats

Ali (a nickname), a father of four daughters, is an employee of the Syrian regime’s Ministry of education in the province of Rif Dimashq, whose salary does not exceed 50 thousand Syrian Pounds (USD 29.17).

Ali told Enab Baladi that half of his salary is used to pay the house rent in Maarba town in Rif Dimashq, held by the Syrian regime. Other housing expenses and bills are covered by working an afternoon shift in one of the warehouses. Ali also receives monthly remittances sent by his brother abroad, which improved his standard of living “compared to those who receive no additional help.”

Economic analyst, Jalal Bakkar, said that “Syrians inside Syria are living day to day and are deprived of any luxury” while adding that most of them have assets and lack cash, as some Syrian families have houses and shops but cannot invest in them because of their almost non-existent purchasing power. He also said that the amount of financial aid and remittances by these families from abroad exceeds the state’s budget.

Shaimaa struggles to survive

Shaimaa Hassan, a resident of Damascus, who arrived in Turkey a few days ago, escaped the “unbearable” living conditions in Syria. In her talk to Enab Baladi, Shaimaa said that remittances and the difference in currency exchange rates are what keeps many families alive in Syria.

Generally, salaries in the public sector are not enough to cover the expenses of one person, whereas in the private sector are considered slightly better; however, salaries in both the private and the public sectors do not exceed 100 dollars a month. According to Shaimaa, “those with no supporters have God on their side”, as she explained that most families inside Syria are “poor” or “below the poverty line” where the majority “at its best live off vegetables and legumes because they cannot afford to buy meat, chicken or cans.”

As for middle-income families, which depend on remittances flow in addition to their income, these families benefit from the difference in currencies exchange; thus, they can afford chicken alongside vegetables and legumes.”

Economy blown away by the ruling family’s internal war

Makhlouf and al-Assad who’s to win?

Crises continue to ravage the Syrian economy while almost disrupting people’s livelihoods; starting from the escalation of war and the stalled production lines amid economic sanctions imposed on the country, to the latest coronavirus (COVID-19) pandemic whilst waiting for “Caesar law” to come into force early next June.

These crises have become more apparent with conflicts between members of the regime’s inner circle in the ruling family, most notably between businessman Rami Makhlouf, Bashar al-Assad’s cousin, and a new stream led by the first lady Asma al-Assad, in an attempt to reconstruct Syria’s economic system, according to financial analysts interviewed by Enab Baladi.

All this raises many questions about the impacts of the ruling family’s inner struggle on the economy in the next phase and the possibility of its further decline.

War of currents

The conflict started between al-Assad, his wife, and some top businessmen from his inner circle, through seizing their movable and immovable assets. This campaign also included Ayman al-Jaber, who established both “Desert Hawks” and “Sea Commandos” militias, and he is even married to the daughter of Kamal al-Assad, Bashar al-Assad’s cousin.

There were also rumors about disputes between Rami Makhlouf and the al-Assad family after seizing his assets in December last year. Such conflicts finally raised to the surface with Makhoulf’s first video recording being posted on his “Facebook” account on 30 last April. Makhlouf’s recording came as a surprise to Syrians and shook off the aura of secrecy that has been surrounding the family for decades, at a time where family disputes were never common fodder in the press.

In three different recordings, Makhlouf showed up talking about being pressured by figures close to the decision-making circle in order to eliminate him from the economic scene by giving up his assets in the “Syriatel” company. His move was followed by several measures by the Syrian regime through seizing his assets, placing a travel ban on him, and exerting more pressure on his economic arms inside Syria, while Makhlouf threatened an economic blow if he complied.

According to Younes al-Karim, an economic analyst told Enab Baladi that the latest twists have uncovered the depth of rift at the heart of the Syrian regime; however, this struggle between Makhlouf and al-Assad is not about seizing each other’s assets but rather a struggle between two different currents.

The first current is led by Asma al-Assad, who represents the new “al-Assad regime” composed by Bashar al-Assad and his small family, in addition to warlords who have emerged during the past years, as well as some security services, officers and law firms. Since this current does not possess an economic power on the ground that can defeat its rivals, its members resorted to the policy of state institutions based on accountability to fight corruption and graft in the second current which is represented by Makhloud and was previously formed by Hafez al-Assad of Baathists and many army and security officials.

Economic analyst al-Karim thinks that both parties tussle over seizing funds, reconstructing, recycling, and pumping them in a way that goes in conformity with their new visions. Consequently, urging each party to use all its might to accomplish this goal.

The bankrupt trader

Dr. Karam Shaar, a Ph.D. holder in economics who works currently as a senior analyst at New Zealand’s Treasury, thinks that the reason behind this rift is the regime’s desire to obtain any sums of money regardless of their source amid its current state of economic bankruptcy. This can be proved through its attempts to collect funds not only from Makhlouf but also by seizing “MTN” assets, a clear indication that “the bankrupt trader” is looking through his old booklets.

Shaar told Enab Baladi that Bashar al-Assad is convinced that Makhlouf has no public support and “he is practically no longer useful for the regime”. Although Makhlouf enjoys a little support by a small group of people who benefit directly from him, he has no actual public support, making the regime’s job in collecting money from him easy, even if the obtained funds (are less than 200 million dollars) compared to the regime’s budget deficit which has ballooned to nearly ten billion dollars in the past three years.

According to Shaar, one of the indicators confirming the regime’s need for funding is when the Council on Money and Credit at the Central Bank of Syria (CBS), increased interest rates on U.S. dollar deposits to reach 5 percent, a rate that cannot be obtained in any part of the world. He added that while interest rates are falling worldwide, Syria’s interest rates are on the rise.

This is a clear indication of the regime’s struggle to access foreign currency and its painstaking search for ways to do so; otherwise, it will collapse, especially that it possesses now less than 100 to 200 million dollars while previously it had 17 billion dollars.

Shaar considered the latest events targeting Makhlouf are merely an episode in a series of events against top businessmen who established fortunes during the past years of war, most prominently, Ayman al-Jaber. The current occurrences shape the regime’s policy to create a new circle of businessmen with a clean reputation able to evade economic sanctions before becoming useless in their turn. In fact, it is an ongoing policy adopted by the regime that does not accept sharing power with others or strengthening businessmen who might pose a threat to its existence later.

How is this tussle going to end?

Research Karam Shaar believes that taking Makhlouf down costs both parties, but al-Assad thinks otherwise since the former is despised publicly. Shaar added that the regime does not like to uncover rifts within its inner circle; however, seizing millions of dollars from Makhlouf amid the current difficult economic situation would contribute to prolonging its existence.

As for economic analyst Abdel Nasser Jassim, he considered that rift between both cousins “is not an economic one, not even a real one”, wondering about its timing by saying “why such struggle emerged at this particular time?”

Abdel Nasser Jassim told Enab Baladi that Rami Makhlouf is the one supervising al-Assad family investments and their work; thus, they will not disagree in such a way, simply because “mafias and gangs” do not resort to law or social media platforms to solves their disputes. According to him, all news circulated by the media inside Syria is spread to create a crisis to manage a bigger one. Hence non-economic reasons are resulting from the current tussle.

Iran…Coronavirus… remittances and “Caesar Act”

Additional reasons for economic deterioration

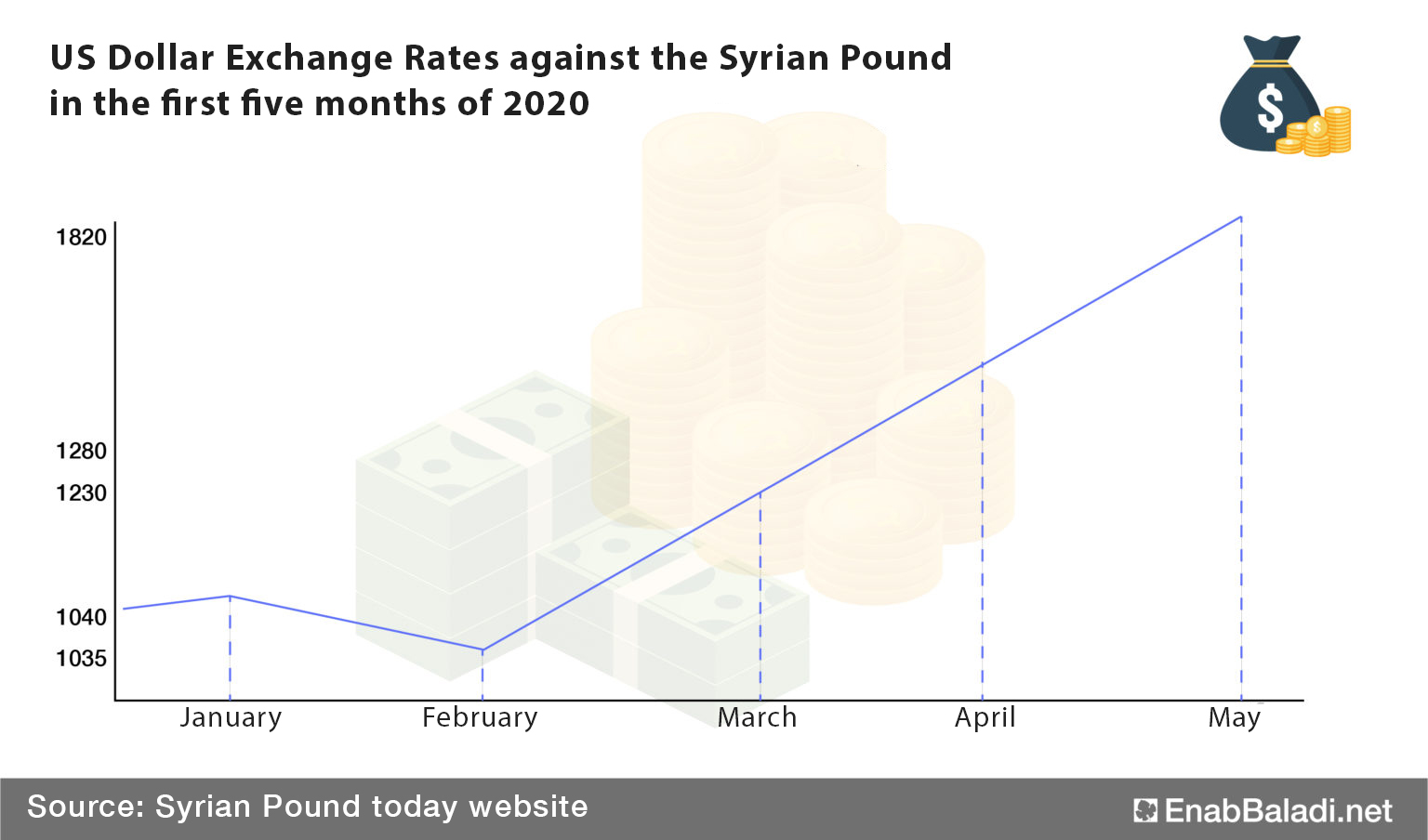

There is absolutely no doubt that the current struggle between Makhlouf and al-Assad has affected the economy as well as the Syrian pound. However, the latest economic crisis and the hike in exchange rates of foreign currencies against the Syrian pound have other causes and factors, according to Syrian economic researcher Karam Shaar, who also confirmed that while many factors take place simultaneously, it becomes difficult to determine the extent of the impact of each of them on the Syrian lira.

The Iranian factor was one of the major factors affecting the exchange rate of the Syrian lira against the dollar, according to Shaar. Being the Syrian regime’s biggest supporter, there are estimates about 30 billion dollars of Iranian funding, in addition to several Iranian oil deliveries to Syria exceeding 10.3 billion dollars.

Meantime Iranian member of parliament, Hishmatullah Fallah Bisha, said in an interview with the state-run Iranian newspaper “Etemad Online”, that Iran had given 20 to 30 billion dollars to the prop al-Assad regime, adding that this money belongs to Iranian people and must be recovered.

Shaar said that after the U.S. withdrawal from the nuclear deal with Iran and the imposed economic sanctions on the latter as well as both Covid-19 and fuel crises, Iran has reached a phase of financial suffocation. This prompted Iran to cut funding for al-Assad and “Hezbollah” in Lebanon. Consequently, al-Assad had to look through his booklets to obtain money, fearing to collapse in the absence of its key funder.

While the second factor behind the current economic deterioration in Syria is the sharp drop in the number of remittances from abroad, according to the World Bank, 1.6 billion dollars worth of remittances flow into Syria every year; however, they have dried up due to the spread of the coronavirus pandemic, as Shaar put it.

The Central Bank of Syria (CBS) does not show official records on the value of these remittances, yet, the pro-regime local newspaper “al-Watan” reported in May 2017, that the value of money transfers to Syria may reach five million dollars per day.

When it comes to the third factor, it is linked to Syria’s internal situation and the “coronavirus” crisis, which has negatively affected the economy and led to work suspension in factories. All this prompted the regime’s government to ease preventive measures imposed since last March, through reopening all business and commercial activities. Al-Assad explained this move, in a speech before the team tasked with confronting the COVID-19 pandemic, on 4 of the current month, by saying “with all this negativity, it became difficult to address all problems at once, putting Syrians between “two options: hunger, poverty, and destitution versus getting the disease”.

“The Caesar Act” also affects both the economy and Syrian pound, as it is scheduled to come into force early next June. The act stipulates punishing anyone who supports the Syrian regime and obligates the President of the United States to impose sanctions on al-Assad allies. Shaar confirmed that without this law coming into force, it is hard to recognize its role, but it will undoubtedly raise fear among investors, urging some of them to withdraw from the market.

Amid al-Assad-Makhlouf conflict…

Is Syria on the verge of an economic catastrophe?

Who will pay the price of al-Assad and Makhlouf spat? What are its effects? What about the gravity of other factors hurting the economy? These questions and more cross many Syrians’ minds directly affected by the drastic decline in livelihood and prices’ hike, which reached its peak during the current tussle between Makhlouf and the regime’s government.

Makhlouf is actually the regime’s economic front-man, who controls many sectors starting by telecoms, banks and real estates, in case the conflict continues without reaching an agreement, it will eventually lead to dangerous consequences, according to the economic analyst, Younes al-Karim.

Citizens under pressure…many sectors will collapse

According to al-Karim, the Syrian regime is currently in a deplorable state, based on stagflation rates translated by (high prices and the scarcity of goods), the widespread unemployment, extreme poverty with more than 96 percent decline in the Gross Domestic Production (GDP) compared with 2011. Consequently, “we are on the verge of collapse, not in the physical sense but the Syrian economy is being transformed into an informal one, where the state is controlled by the rich, which is the current situation.”

This transformation will have hurt the Syrian pound, which became apparent after Makhlouf’s first video recording, as the exchange rate of the Syrian pound went up from SYP 1,250 to SYP 1,900. In the past few years, the regime had little room for economic maneuver regarding goods prices, securing needs as well as controlling exchange rates; however, the recent clashes between the new regime and the old economic guard have hampered its efforts to do so.

Economic analyst Abdel Nasser Jassim thinks that the primary victims of these disputes, whether “they were fake or real,” are Syrians who are going to lose faith in their economy, along with many other economic reasons. All this will affect the Syrian lira in a massive way, which will be reflected by prices’ hike, which will eventually weaken citizens’ purchasing power.

For Jassim’s part, Syrians are already “overwhelmed and exhausted”. He explained that three months ago, people needed 250 thousand Syrian Pounds (USD 145.8) monthly to secure their food only, while since the beginning of the current year up to now, despite the change in the dollar exchange rates, people’s capabilities and incomes have not changed. Syrians will “pay the price” of that change and will be reflected in their standards of living. Hence they will be prompted to try to adapt themselves with the new standard of living through the use of the few ways and tools they possess.

The current tussle will be reflected on investments inside Syria, whether they were conducted by Syrians or Arabs. In fact, the conflict has caused the loss of local investors’ trust, who started their projects only to stop them later out of fear of losing their capitals or being subjected to a similar “illegal” campaign like the one launched on “Makhlouf” by al-Assad using his authority, according to Younes al-Karim. He explained that Makhlouf partners in many economic sectors fear al-Assad and his wife after the incident, which prompted a lot of them to suspend their business activities or even flee the country and wait to see what will happen next.

Al-Karim thinks that warlords’ fear, who appeared in the past few years, will urge them to take their money out of Syria, while small speculators dream of making profits and start purchasing foreign currencies (USD) for the benefit of large speculators. This resulted in an increase in the exchange rate because of the high demand for dollars. As for small traders, they started exchanging their liras to dollars to ensure their ability to buy goods when needed.

All these factors may result in the collapse of the system of prices, weaken the purchasing power of citizens, and a sharp decline in the value of the Syrian pound, which constitutes the essence of the Syrian economy.

Additionally, the recent rift between al-Assad and Makhlouf will drive foreign investors away from the Syrian market for being unstable and insecure. This will create more confusion for Russia, which tries to convince other countries to begin the reconstruction phase, especially Gulf countries that probably will use “the Caesar Act” to avoid any ties with the Syrian regime.

Do you believe Makhlouf Threats?

On 17 of the current month and during his third video recording, Makhlouf promised of deteriorating economic conditions when he warned against “Syriatel” collapse as a result of Syrian regime practices. Makhlouf pointed out in his last appearance that a collapse of his company will result in the collapse of the Syrian economy since it serves “a large portion of the Syrian society”, as he put it.

Syrian tycoon Rami Makhlouf controls the Syrian economy, as he was thought to control more than 60 percent of it, according to Russian media reports. However, Dr. Shaar doubted that and described it as “impossible”, since Makhlouf’s contributions to GNP and other economic sectors such as the agricultural one are very minor. Shaar believes that Makhlouf’s contributions in the Syrian economy do not exceed 10 percent, and yet it is a “scary” number.

About Makhlouf threats of an economic catastrophe, Shaar believes those threats to be exaggerations about his role and contributions in the Syrian economy, in order to convince al-Assad and his men to stop chasing him. Economist, Abdel Nasser Jassim, shared the same opinion and considered Makhlouf’s threats an attempt to create media buzz, while the rest is linked to international political circumstances related to the “Caesar Act” and its entry into force, U.S. threats, in addition to both Russia’s confusing role and Iran’s weak one in the region.

Jassim described the economic situation and the living conditions inside Syria as “catastrophic” and said that “we cannot talk about a catastrophe beyond the current economic one with more than 83 percent of Syrians under the poverty line” while blaming the regime and its partners for failing to find solutions and ways to deal with this crisis and to act as a state.

No solutions for sanctions

The future of the Syrian economy and the prospect of its collapse have become the central preoccupation of many Syrians and analysts; however, to this moment, there is no clear definition for this notion in economics, according to researcher Karam Shaar. Hence, it becomes difficult to predict its occurrence even with the increase of its likelihood.

Shaar confirmed that what the Syrian economy is going through today cannot be called a collapse but rather an “economic recession”, and things might get even worse in the near future.

In his talk about solutions, Shaar believes “there is no way out when it comes to sanctions, especially with the “Caesar law” coming into force”. He explained, “the regime has reached a phase of financial suffocation, preventing it from making any drastic solutions amid the imposed economic sanctions, while resorting to patchwork ones.”

Shaar explained that among patchwork solutions the regime works on, there is the idea of shortening supply chains where goods are purchased by consumers directly from their initial suppliers. Such a move might help in the reduction of costs, but no in a significant way. In addition, the Syrian regime could be allowing popular markets to reopen again after closing them.

Moreover, al-Assad asked the Syrian Trade Corporation in the regime’s government to draft urgent laws to punish monopolists and to be the leading player in the Syrian market through cutting out trade intermediaries between consumers and farmers.

Researcher Younes al-Karim thinks that the regime can reconcile with Makhlouf and reconstruct both the old and new systems for a new vision; that it can be used to persuade its allies (Russia and Iran) to invest in the economy. The Syrian regime can also rearrange its priorities and restore its ties with the Gulf states, being al-Assad’s backbone, pointing out to this solution’s effectiveness in the past years, as it helped al-Assad to remain in power without officially losing his legitimacy.

if you think the article contain wrong information or you have additional details Send Correction

النسخة العربية من المقال

-

Follow us :

Most viewed

- 311 casualties among government forces and civilians in Syrian coast

- Rights organization documents government and civilian deaths in Syrian coast

- Al-Shibani: Syria is facing a hidden and declared war

- Ankara supports Damascus... Moscow abdicates responsibility for events in coastal region

- The Makhlouf dynasty: privilege, power, and wealth

An old man carrying a bag in the Bab Musalla area in Damascus (Edited by Enab Baladi)

An old man carrying a bag in the Bab Musalla area in Damascus (Edited by Enab Baladi)

A

A

A

A

A

A

More In-Depth

More In-Depth