Enab Baladi’s investigation team: Mourad Abdul Jalil | Mohamed Homs | Mais Hamad

Over the past four decades, salary increases in Syria have been linked to fears of a rise in prices, which citizens expect based on experience and on indicators linked to the economic policies of the Syrian regime.

However, the recent increase in salaries, which was approved on November 21, did not bring new expectations, as prices started rising a week before its approval, following the deterioration of the value of the Syrian Pound since the beginning of this month, reaching record levels; thus, foreshadowing a continuous rise in prices.

Despite the pledges of the Ministry of Internal Trade and Consumer Protection in the government of the Syrian regime not to raise prices by business owners, after the increase in salaries, Enab Baladi spotted a rise in prices of some commodities, exceeding 20%.

In contrast, the Minister of Internal Trade and Consumer Protection, Atef Naddaf, said that he will firmly confront those who intend to raise the prices of any foodstuff or consumer goods, and that the items will be offered at their “reasonable” prices. Logically, the continued decline of the Syrian Pound’s value will necessarily lead to higher prices.

Rising prices will not be the only negative consequence of the depreciation of the Syrian Pound, as the collapse of the currency will be followed by a set of far-reaching consequences, which will be reflected in direct economic and social effects on citizens.

Through interviewing a group of analysts and economic researchers, Enab Baladi tries in this file to find out the direct reasons that led to the significant decline of the Syrian Pound’s value over the past few weeks, as well as the effects of the salary increase and the continued decline of the Syrian Pound’s value on Syrian citizens and economy.

A citizen sitting and thinking in Qadam neighborhood, Damascus – September 16, 2019 (Lens of Young Dimashqi)

Central Bank, investors and “trust”…

Direct reasons for the deterioration of the Syrian Pound’s value

“How much is the exchange rate today?” is a question raised daily by Syrians, especially in regime-controlled areas, and becomes the center of usual talk, whether in private meetings or in their work in government departments, amid fears of the unknown future in the absence of a perception of the limits of the deterioration of the Syrian Pound. All this portend a difficult living reality and further worsening of the economic situation.

Many reasons have led to the depreciation of the Syrian Pound over the past few days, despite maintaining its levels last year at around 500 Syrian Pound. The first of these reasons is that the Syrian government’s treasury has run out of hard currency (the Dollar), as economic analysts that Enab Baladi interviewed have unanimously confirmed.

Several reasons

Economic analyst Munaf Quman believes that the longevity of the conflict is a major factor that cannot be overlooked in the depreciation of the Syrian Pound. Nevertheless, recent developments have led to a further depreciation of the Syrian Pound, including the insufficient Dollar currency in the state treasury, which is caused by the suspension of the “Iranian credit line” and the financial support by the regime’s allies, leading to the regime’s need for hard currency to buy and afford the citizens’ basic needs of fuel, food, medicines and other necessities.

According to Quman, this has led to a state of “panic” after hinting that the regime could no longer fulfill its entitlements, prompting the black market, which is the main driver of the Syrian Pound exchange rate, to raise the market price threshold.

The loss of citizens’ trust in the Syrian Pound and fears of its continued decline also played a major role in the currency’s depreciation, by replacing the Dollar with the Syrian Pound on the black market and at the cashiers, according to the Minister of Economy and Finance in the Syrian Interim Government, Abdul Karim al-Masri.

As for the other reasons that led to the depreciation of the Syrian Pound, al-Masri explained in an interview with Enab Baladi that they include the Central Bank’s loss of the foreign exchange reserve balance, the decline in GDP and the trade balance deficit, i.e., the increase of imports on exports, as Syria is now importing commodities it used to export in the past, such as oil, in addition to the debt owed by the Syrian regime to its allies, especially Iran.

In addition, the exodus of capital and investors from Syria has negatively affected the GDP and significantly increased unemployment, which led to the exit of foreign currency from Syria.

Al-Masri believes that the investors’ “safe” return and investments that meet the needs of the country will lead to increasing domestic production, introducing foreign currency and easing imports, and consequently to an improvement in the Syrian Pound.

The former Minister of Economy in the government of the Syrian regime, Nidal al-Shaar, linked the return of investors from outside Syria to the improvement of the Syrian Pound. He repeatedly stressed via his Facebook page that “neither the Central Bank nor the government or any other party would be able to correct this path (depreciation of the Syrian Pound). There is no other solution than the return of investors with all their productive and humanitarian capabilities and various tools for which they have been known over the years, provided that the return be safe and free of fears for those who left.”

For his part, economic analyst Younis al-Karim considered that rumors have a significant role in the depreciation of the Syrian Pound, as the mere circulation of rumors about the decline of currency and exchange value significantly affects and worries citizens, motivating them to replace the Dollar with their currency. Al-Karim clarified that this is an “unethical” act that is being promoted.

Government silence broken by salary increases

The depreciation of the Syrian Pound has been accompanied by a silence by Syrian regime officials and the Central Bank, with the exception of some statements in which the Bank denied the adjustment of the official exchange rate, which amounts to 438 Syrian Pounds per Dollar, a difference of 312 Syrian Pounds from the black market. This opens the door for speculation due to the large difference between the two prices.

The silence of the regime’s government is due to its inability to provide any solutions and the drainage of all the bills. The most recent solution was the “Businesspersons Initiative,” last September, when the Central Bank gathered Syrian businesspersons to create a fund in order to support the Syrian Pound.

However, the initiative was only a “psychological game,” especially since the Dollar’s needs are far greater than the figures included in the initiative, especially given the failure of Syrian exports to persist in the markets that were opened for them, in return for a steady increase in imports requiring foreign currency financing.

In addition, Syria’s needs for oil derivatives are now demanding cash and semi-immediate payments as a result of the imposed sanctions on Iran and the latter’s suspension of its credit line, which has severely increased pressure on the exchange market, stated international economic relations researcher Abdel Moneim Halabi to Enab Baladi.

Silence continued after the Dollar broke the 700-pound barrier and reached 740 Syrian Pounds, until Bashar al-Assad issued a decree to raise salaries and the minimum of some wages, despite repeated statements by government officials that no salaries would be raised without the finalization of production priorities, the economy’s return to real growth and the increase of government resources.

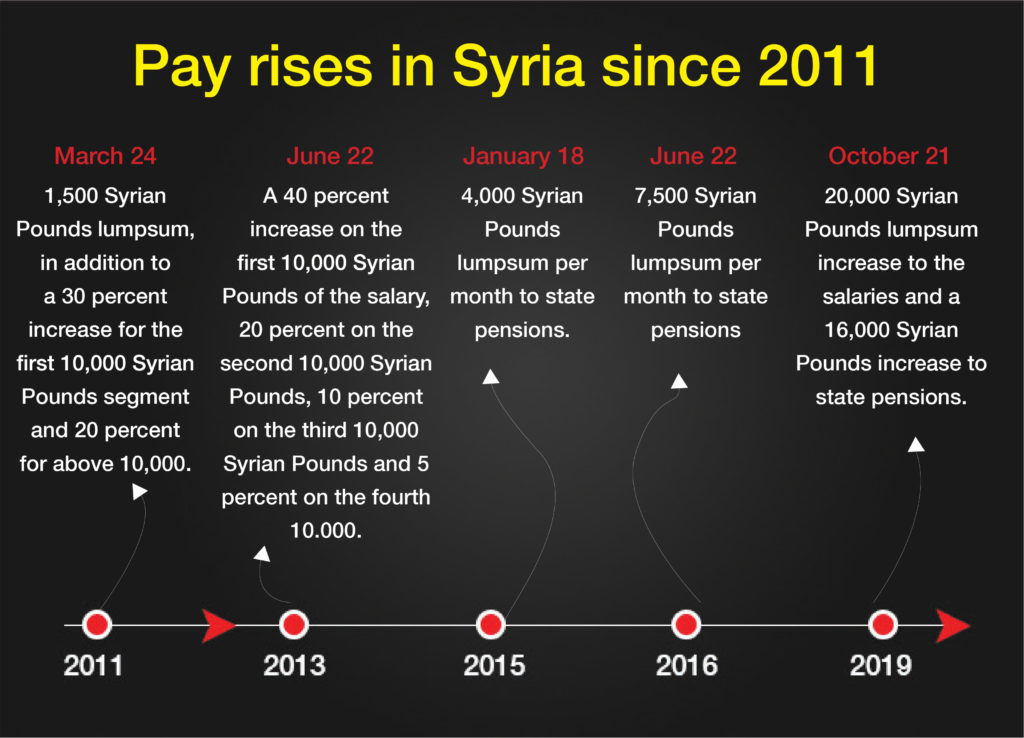

The salary-increase decrees 23 and 24 of 2019, issued on November 21, provided for the addition of 20,000 Syrian Pounds (US $ 26) to the monthly salaries and wages cut for both civilian and military workers, and the addition of 16,000 Syrian Pounds (US $ 21) to the salaries of military and civilian pensioners.

Regarding the way the regime’s government would manage to pay salaries, Quman said that the government will pay them using the funds of the same budget, since the authorities have enough Syrian Pounds and the salaries will not be transferred in Dollar or other currencies. Thus, he pointed out that the regime has already delayed salaries increases repeatedly, even though the matter has been discussed earlier.

The Syrian regime had postponed salary increases, according to Quman, because increasing cash in the hands of employees would lead, in the absence of production and foreign currency, to higher prices in the markets; thus, entering a new phase of the challenge, which the regime may not be able to handle, especially if inflation rates raise and the Syrian Pound depreciates further.

According to Quman, the regime may have been waiting for a breakthrough soon after taking control of the rest of the territories, previously seized by the opposition, as al-Assad hopes to restore his government’s international and regional legitimacy, lift the sanctions and receive the reconstruction funds, as these gains will reanimate to the economy. However, if this scenario does not become a reality, then the Syrian economy will remain stalled and economic crises will accumulate.

New denomination of currency awaiting Syrians

What are citizens’ options?

The rapid depreciation of the Syrian Pound was accompanied by paralysis and confusion in the markets, amid anticipation of the coming developments, the near future effects of salary increases and the continuous decline of the national currency.

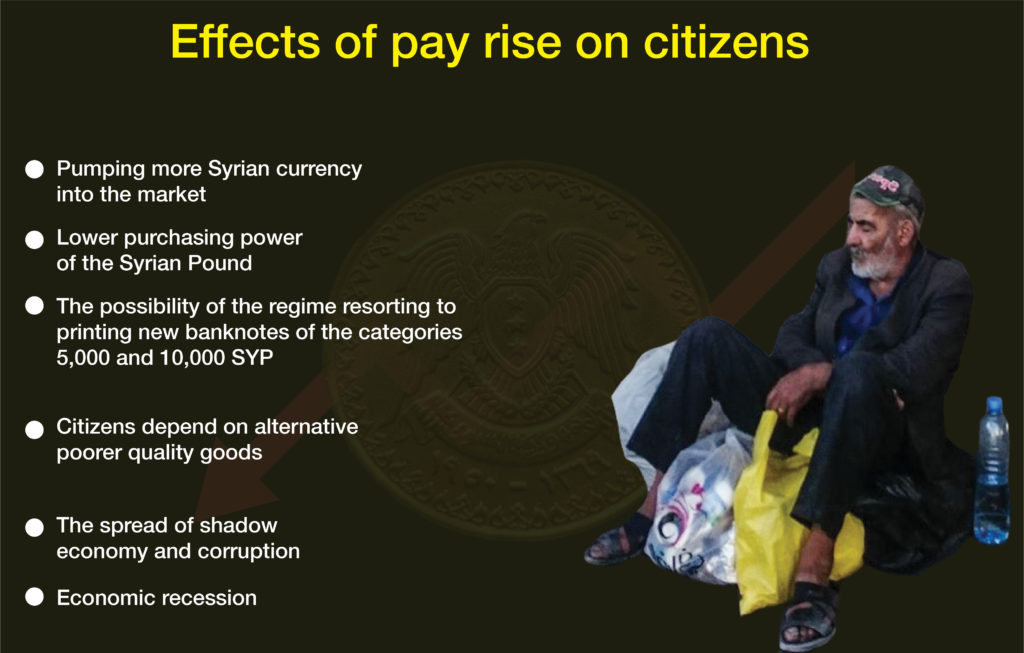

Quman predicted that if the Syrian Pound’s value declines further, the regime’s government will adapt to the new situation by printing a new denomination of currency of a higher category, such as 5,000 or 10,000 Syrian Pounds, and ban denominations of low value. This step is considered as a conventional measure that countries resort to when their currencies significantly depreciate and prices go higher, causing a monetary dysfunction.

“The economic legislator will deal with the current reality and recognize its impact, as the government is already aware of the possible repercussions and the need to adapt and implement changes,” Quman added.

According to the economic researcher, the Syrian citizen is held hostage by a “totalitarian government,” so he stands helpless, unable to do anything, despite the fact that his “hard work and financial merits have been damaged by the regime’s policies. Thus, with the imposition of the new reality and in case the dollar exchange rate reaches 1,000 Syrian Pounds, the Syrian citizens will face two options: either adapt to the new situation and carry on living, or to reject the status quo and demand change.”

Changing consumer patterns

For his part, economic researcher Younis al-Karim, stressed that the negative impact of the salaries increase is the continuous devaluation of the Syrian Pound, which will lead to the pumping of more Syrian currency bills, through loans granted to people by public banks.

In this case, the Syrian citizen will have an abundance of the national currency without being matched by commodities, especially if consumer loans are intended for luxury goods with the duration of less than a year, which means increased demand for the absolvatory Dollar.

Al-Karim also informed Enab Baladi about the consequences that could be “disastrous” with the continuous depreciation of the Syrian Pound, and the corresponding rise in prices in the Syrian market, in case these problems are not taken into account and addressed in the best way, both at the individual and collective levels, as well as in local markets and industries.

The economic analyst clarified that the ongoing collapse of the Syrian Pound “has a devastating effect” as it will result in the decline in purchasing power. Therefore, the local products will become too expensive for Syrians to get, which may lead to the collapse of industries due to the weakness of commodities’ distribution in markets, the increase of unemployment rates, higher prices and the shortage of goods.

The depreciation of the Syrian Pound will also affect imported goods, which will become overpriced, prompting citizens to rely on alternative goods that may be of poor quality. This situation will further deteriorate societal constituents, public taste, consumer patterns and everything related to consumer behavior, which is part of the country’s culture. In the long run, this will make any advanced or successful industry useless in a market where purchasing power is low.

Rise of the shadow economy

| There is no specific definition of the shadow economy or the underground economy. The term stands for the sale of products in secret at a lower price than the market price, without paying taxes, as well as the employees’ evasion from making compulsory contributions; i.e. tax funds, which are spent to endorse local public services. |

The continuous decline of the Syrian Pound will lead to empowering the shadow economy and corruption. Thus, citizens will work in more than one sector, which will affect the quality of local services, including education, health and other sectors, according to al-Karim.

He continued: “The Syrian Pound is a guarantor of national security, due to its close link to all the pillars of a healthy society.” The collapse of the Pound can affect the public sectors, resulting in the citizens’ inability to buy medications and food, which will increase the rates of school drop-outs, and child labor, in addition to damaging the educational process and social composition.

This scenario will affect all the pillars of social stability, according to al-Karim. The researcher pointed out that “the possibility of increasing the military action, and the consequent unrests, can entrap the country in a state of destructive chaos, amid a struggle for survival, with the emergence of warlords who will live extravagantly.”

Will the deterioration of Syrian Pound lead to economic depression?

|

Al-Karim pointed out that what is happening in the local market is an economic recession, i.e. there is a currency abundance and an expansion in monetary policies versus a decline in demand, due to the high level of prices and the increase in the market supply of goods; as a result of smuggling and the prosperity of the shadow economy. This economic recession will lead to the increase of supply without being matched by an equivalent demand or sufficient distribution of goods. The economic analyst added that Syria is entering the afore explained zone of recession, which may result in further social collapse due to the availability of goods and the weakness of purchasing power. Thus, he preferred not to use the term depression to describe what is happening in the Syrian domestic market, explaining that Syria is a non-industrial country. He drew the difference between the terms recession and depression in terms of longevity, noting that a depression lasts for more than a production cycle, while a recession affects one production cycle between three and nine months and does not exceed it. During the recession, purchasing power shrinks, supply increases, and demand decreases, as a result of reduced purchasing power. Supply also increases or remains available, but without demand. During the depression, industrial activities are blocked in industrial countries, unlike Syria, while the recession affects trade countries. The economic analyst pointed out that dealing with the effects of recession is easier than the consequences of depression, because the latter leads to paralysis of Gross Domestic Product (GDP). |

Can the Syrian regime save the Syrian Pound?

The government of the Syrian regime pursued several policies, through the Central Bank, which tried to keep the Pound at an “acceptable” exchange rate through the most recent initiative called “My Currency is My Strength” launched by the Bank with the support of Syrian businessmen, the end of last September, but these did not work. The member of the Board of Directors of the Damascus Chamber of Commerce, Hassan Azqoul, declared on November 12 that these policies have been temporarily suspended because the Central Bank is working on new executive instructions to grant funding through the initiative fund.

But the financial advisor and researcher in international economic relations, Abdul-Moneim al-Halabi, stated in an interview with Enab Baladi that the Central Bank is unable to secure stability in the exchange rate of the Syrian Pound at the levels of 600 and 700, since it still “abides by the directives of the regime’s government not to intervene in the market exchange, due to very low Dollar reserves in the Treasury.”

Former policies

The Central Bank had previously pursued two policies, according to al-Halabi; one was the intervention sessions that were carried out during the reign of the former Governor of the Bank of Syria, Adib Mayaleh (2005-2016), to control the exchange rate of the Pound.

He stated it was “used either for the benefit of businessmen close to the Syrian regime, who supported during the Syrian war the factions of the regime, or to conclude deals to circumvent the sanctions imposed on Syria, through the sale of millions of Dollars in those sessions in cooperation with exchange companies.”

Despite the strong objection to Mayaleh’s policy, the Bank confirmed that it would continue its intervention sessions and pump the Dollar into the market. According to a statement it issued in June 2016, the Bank was “continuing to apply various traditional and unconventional monetary policy measures. The most important ones are direct market intervention and liquidity management to adjust foreign-exchange demand, and relative exchange-rate stability.”

Mayaleh stressed, through the newspaper “al–Ba’ath,” that “the Central Bank has become the main player in determining the size of supply and demand for foreign exchange in the market, through its recent measures to control liquidity and increase the supply of pieces in the market.”

Although, in an interview with al-Machhad on November 20, Dr. Shafiq Arbash, a professor at the Faculty of Economics at Damascus University, accused Adib Mayaleh of draining Syria’s foreign exchange reserves by resorting to auction policy (intervention sessions) between 2011 and 2016.

Arbash stated that “Mayala resorted to methods adopted in other countries and proved their failure, namely, the auctions that led to the depletion of Syria’s foreign exchange reserves, even with good intentions. When it has been proved that the auctions did not achieve their intended purpose, why did he continue presiding his job following auctions failure from 2011 to 2016? ”

As for the other policy, according to al-Halabi, it was “the intervention through banks that were followed during the era of the former Central Bank Governor, Dureid Dergham, which allowed securing the Dollar at the regular price determined by parties supporting the Syrian regime.” But, the policy is not currently used.

Dergham rejected the direct intervention policy in the market and considered it “wrong.” He said, according to the local site “Economy today” in May 2017, that “interference in the foreign exchange market is a wrong policy and unjustified. It contributed to the depletion of reserves, and as a result, the Central Bank took a decision to stop it.” He also pointed to the existence of many monetary instruments to deal with the decline in the exchange rate without resorting to pumping foreign currencies into the market.

A person inside a remittance office in Jordan counting the Syrian currency after exchange (THE JORDAN TIMES)

“Freeing the market”

Regarding the current policy adopted by the Syrian regime, al-Halabi explained that “the regime’s government and the Central Bank left the market to set a balanced price without interference. They may resort to floating the Pound and play on the psychological factor with campaigns similar to the initiative of “My Currency is My Strength” posed by the Bank along with Syrian businessmen in late September. ”

And by floating, he means that the Central Bank will not be responsible for the determination of the exchange rate, and let its exchange rate be determined according to the forces of supply and demand in the money market; that is, linking the value of the currency to the demand for it.

Al-Halabi believes that the efforts of the regime and the Central Bank at the present time revolve around the “search for a stable level, even if it is low for the Syrian Pound. This way would give the Pound a competitive price for Syrian exports, and the financing of such resources to fund imports, in order to create a balance in the market without interfering and depleting the remaining the semi-depleted Dollar reserves,” as described.

However, the possibility that the regime’s government would put forward projects or initiatives or announce an economic plan seemed unlikely to al-Halabi, who considered that the regime “does not care about the opinion of the street and what can be done.”

Improvement is contingent on political settlement

As for the Syrian Pound exchange rate, after the possibility of reaching a political solution, al-Halabi explained that “Syria’s problem is political and resolving it in a way that leads to an acceptable stability will inevitably reflect positively on the reality of the Syrian economy as a whole, especially with regard to the reality of investment and fighting unemployment.”

The political solution will also “restore the competitiveness of exports and reduce consumer imports, which will naturally lead to the balance and stability of the currency, and having enough time to face the inflation and decline in real income of the Syrian citizen.”

Al-Halabi pointed out that the time frame for the recovery of the Syrian Pound is still vague, and needs programs supported internationally, with the ability to attract investments and human as well as financial resources and the development of infrastructure and the legal environment. But, in the short term, “things are heading to a new level to exchange the Dollar against the Syrian Pound between 800 and 850.”

if you think the article contain wrong information or you have additional details Send Correction

النسخة العربية من المقال

-

Follow us :

Most viewed

- Turkey moves to deploy air defense system in Syria

- Daraa mobilizes against Israel... Civilian casualties

- SDF to withdraw from Aleppo neighborhoods following agreement with Damascus

- Washington's conditions raise questions about its openness and goals in Syria

- Western perspective on Syria: Focusing on foreign jihadists

A Syrian man carrying a 2,000 Syrian pounds banknote. (shutterstock)

A Syrian man carrying a 2,000 Syrian pounds banknote. (shutterstock)

A

A

A

A

A

A

More In-Depth

More In-Depth