Homs countryside – Orwah al-Mundhir

Real estate prices of northern Homs countryside remain at very low levels compared to the hike of property prices in the Syrian capital Damascus and other provincial centers despite the relative security and stability prevailing in northern Homs countryside after the Syrian regime’s forces re-controlled the area under a “reconciliation” agreement with Russia’s auspices, in mid-2018.

The property market of northern Homs countryside is almost entirely governed by the law of supply and demand. It is not affected by the continuous decrease in the value of the Syrian Pound (SYP) against other currencies, especially the US dollar (USD). Such is the case in Homs city, where properties are implicitly priced like vehicles in the US dollar.

For instance, an apartment in the al-Waer district within Homs city is worth about 25,000 USD; nevertheless, its price in the Syrian Pound may go up or down based on the dollar exchange rate. This does not apply to the real estate sector in northern Homs countryside due to the weak demand and abundant supply in general.

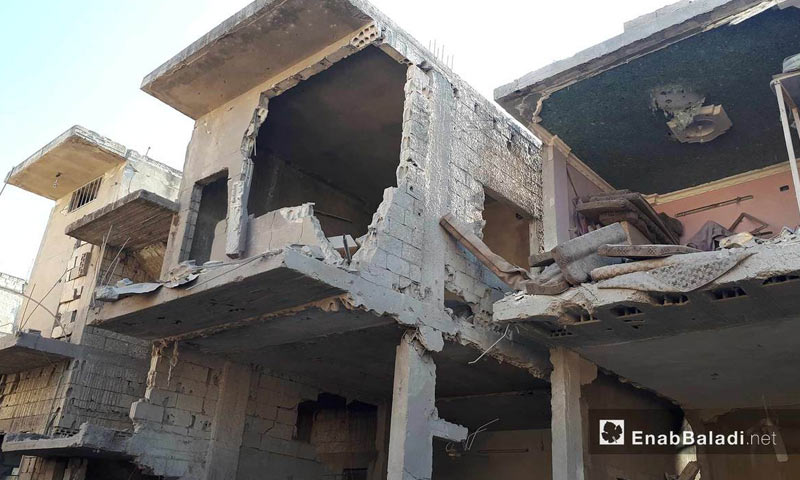

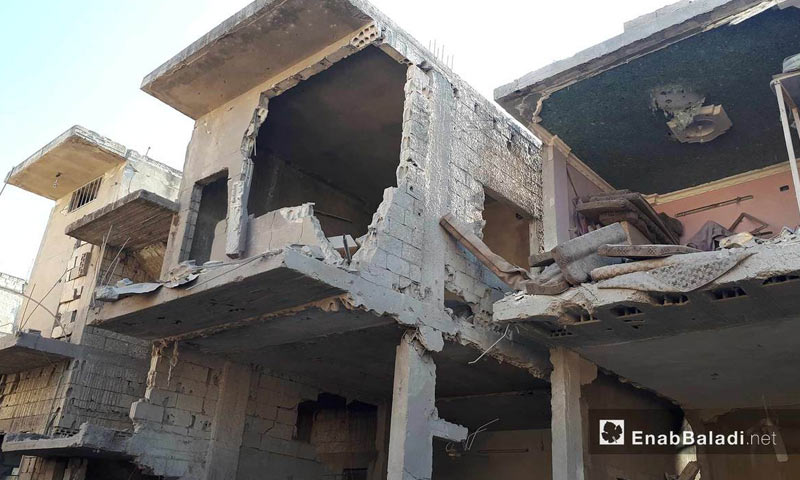

The military offensives launched by the Syrian regime and its Russian ally have caused massive destruction in the private and public properties in northern Homs countryside.

According to the United Nations Institute for Training and Research (UNITAR), the number of completely destroyed buildings in Homs province has reached more than 3,000.

Another 6,000 buildings were severely damaged, while nearly 5,000 buildings were partially destroyed. The total number of affected buildings amounted to 13,778.

Citizens of northern Homs countryside were unable to rehabilitate their destroyed houses; therefore, most of them offer their houses for sale, thus causing an oversupply in the property market.

In an interview with Enab Baladi, Mazen Maarati, a resident of Kafr Laha town of al-Houla Plain, northern Homs countryside, said that his house was completely destroyed after a barrel bomb was dropped on it, in mid-2014.

Maarati added, “At that time, I sold the wreckage of my destroyed house to the crushers because I was unable to rebuild it, and I wanted to build a new house on my farm, which is a bit far from the city center.”

“My house has been on the market for nearly three years, without a possible buyer,” said Maarati.

Although house prices have increased significantly amidst the stagnant residential market in the region, they have not reached to match houses’ construction costs. The selling price of a house whose current construction cost is worth 15 million (SYP = 8,241 USD) does not exceed ten million (SYP = 5,494 USD).

Moreover, the prices of building materials are rising automatically as the US dollar’s exchange rate increases against the Syrian Pound. Also, the cost of construction labor is increasing rapidly, while the selling prices of houses are not hiking at the same pace.

Enab Baladi interviewed Qasem Katgo, a real estate office owner in al-Rastan city, who said: “The construction costs are currently very high, people are resorting to renting houses more than building due to the substantial costs, hoping for lower prices in the future.”

Katgo added, “the properties’ prices are not commensurate with the cost of their construction or the price of their lands. There is a great supply for real estate but no demand, for people do not have money, and when there is an interaction of sellers and buyers, the market determines the price.”

On 21 of last January, the government of the Syrian regime issued a decision in which it announced restricting the process of completing the purchase contracts of real estates and vehicles by paying through the public banks starting from mid-February.

On the other hand, the public banks set out the daily withdrawal limit for bank account holders, whose funds resulted from the sale of the property. Nevertheless, several economic analysts considered that this decision would cause an additional gridlock in Syria’s real estate trade.

As the value of the Syrian Pound was declining, the real estate prices remained near-constant or slightly increased. This kept traders away from engaging in real estate bargains except in cases where there are available apartments at attractive prices or when they wanted to buy for possession rather than commercial purposes.

Muhammed Nassour, a real estate trader from Talbiseh city, said to Enab Baladi “I bought a farm to invest in agriculture, two months later, I sold it when the Syrian Pound’s value started to drop.”

The trader pointed out that he bought the farm when the average exchange rate of the SYP was 545 against USD, then he sold it when the exchange rate became 610 SYP per 1 USD.

Nassour considered that he avoided a loss, given the continued decline of the Syrian Pound’s value. He added that “no investment can compensate for the loss caused by the exchange rate difference, no matter how big it is.”

Abu Mahmoud, a shop owner in al-Rastan city, spoke to Enab Baladi on the condition of anonymity and pointed out that he sold his store for 15 million SYP, about 11 thousand USD in last April, while he could sell it last year for ten million SYP, around 13,000 USD, at that time.

This indicates that any buying or selling movement in the real estate market has become of high risk to traders.

if you think the article contain wrong information or you have additional details Send Correction