Enab Baladi – Jana al-Issa

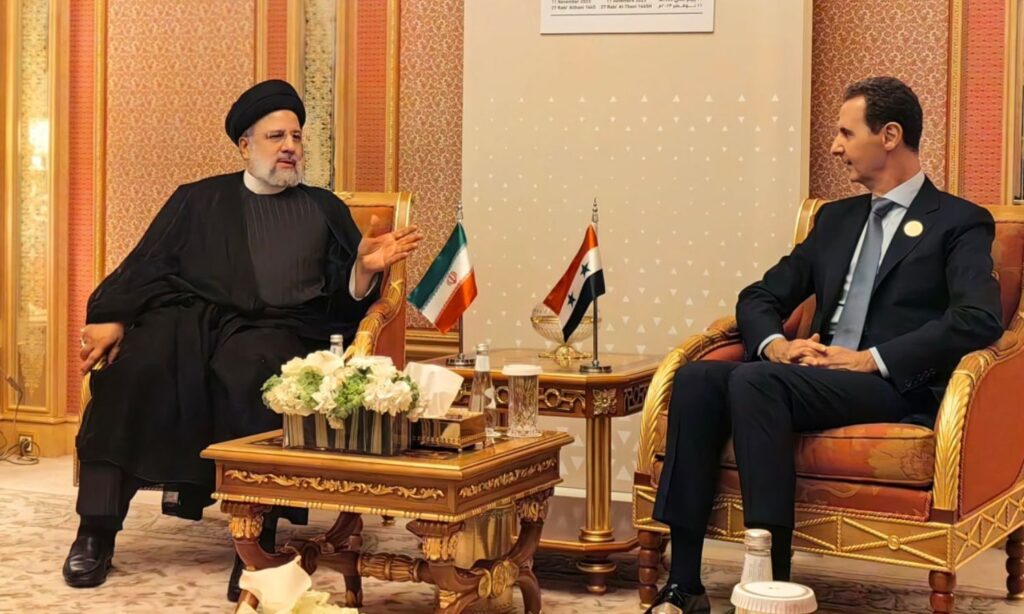

At the end of April, the Saudi newspaper, Asharq Al-Awsat, reported from sources described as being well-informed in Damascus, stating that Iran has been pressuring the Syrian regime government to recover its debts since the latest visit made by Iranian President, Ebrahim Raisi, to Damascus in May 2023.

The sources added that Iran is pressuring the regime to recover debts amounting to 50 billion US dollars by obtaining investment projects, especially after the two sides signed a “Memorandum of Understanding for Strategic Cooperation” during Raisi’s last visit.

Tehran insists on implementing the numerous agreements signed between the two countries in order to repay the debts, according to the sources.

Agreements on paper only

Over the past years, Iran has obtained numerous investment contracts in various sectors, such as telecommunications, health, education, energy, banking, construction, agriculture, animal resources, electricity, and others.

Many of these agreements have not been implemented on the ground, with no clear indication of impediments to their execution by both parties.

Iran has not previously commented on its keen interest in putting these agreements into genuine implementation, leading experts and followers to consider that the absence of their execution stems from an Iranian desire to reserve positions and investments in Syria without a hurry to implement them in the near future.

Debt collection committee

On April 25, 2023, the Syrian-Iranian economic committee met, with the participation of the Minister of Economy in the regime government, Muhammad Samer al-Khalil, and the Iranian Minister of Roads, Mehrdad Bazrpash, along with representatives from both sides in sectors of economy, trade, housing, oil, industry, electricity, transport, and insurance.

This meeting resulted in the formation of eight specialized economic committees in different sectors, with the eighth committee concerned with following up on debts and dues, to conduct a thorough investigation of the debt size, after previous agreements regarding giving land as an alternative to these debts.

Iranian Minister of Roads and Urban Development, Mehrdad Bazrpash, stated at the time that the Iranian side “understands Syria’s circumstances, but there are some laws in Iran that require answers,” according to what the Iranian minister told the Syrian newspaper Al-Watan.

With talks about Iran’s debts of about 50 billion US dollars, Iran has suggested to the head of the Syrian regime, Bashar al-Assad to offer land as an alternative to money as a way to settle the sides.

Tehran feels cheated

Researcher specialized in Iranian affairs, Diaa Qaddour, said that the Syrian regime is unable to pay Iran’s debts, and among many leaked files, it was found that Iran recognizes al-Assad’s procrastination in paying these debts.

Qaddour explained to Enab Baladi that, so far, Iran has reached agreements that enable it to collect a very small part of the debts it gave to the regime across various sectors, in the civil part only, without discussing the military part.

Qaddour believes that Tehran feels aggrieved in Syria, as its presence there is deemed the most failed project it has led in foreign policy, aimed at protecting the regime’s rule without receiving anything in return, according to his expression.

The researcher also noted that Iran is still forced to provide more in Syria, without signs of getting something in return, making it an unproductive and negative economic investment.

Qaddour pointed to a dispute between the Syrian regime and Iran that has begun to surface, highlighted by Iranian pressures for larger investments on one hand, and unprecedented criticisms by regime loyalists regarding the Iranian presence in Syria.

“Submissive” agreements amid Arab rapprochement

Dr. Firas Shaabo, a financial and banking sciences expert, sees the agreements signed between the Syrian regime and Iran as “submissive” agreements, signed at a time when the regime was forced into them under very unfavorable terms and conditions.

Shaabo explained to Enab Baladi that the frequent visits by Iranian officials to Damascus to reinvigorate the agreements signify discontent with the regime’s slowdown in implementing projects and agreements, especially those related to infrastructure and energy.

Iran tries to make the most of every dollar put in Syria, closing the chapter on continuing to pay, so the coming days will witness greater Iranian pressure on the regime to collect what it has paid, especially amid Russian slicing of a large number of investments.

Iran also uses these agreements as leverage against the regime, the more Arab closeness to the regime includes demands to distance Iran and reduce its presence in Syria, Tehran raises this card against the regime, according to Shaabo.

Shaabo sees that the regime deliberately slows down and procrastinates in executing these agreements because it fully realizes that if Iran controls the sectors covered by the agreements, nothing will remain for it, especially amid its significant financial resource weakness.

Russia has the upper hand

The achievements made by Iran in the Syrian economy consist more of credit lines and loans than trade, according to a study from the Syrian Dialogue center in March 2022.

Despite multiple commercial failures, Iran continues to strive to increase trade for various purposes, most notably to recover as much debt as possible and because of the importance of this exchange for its soft power needs, which are essential for developing long-term influence and economic relationships.

According to the study, after 2015, Iran sought to establish itself in all the main sectors in Syria; despite its significant efforts in this area, the actual success and level of its control vary from one sector to another, amidst ongoing and continual Iranian attempts to increase its positioning in each one individually.

The study indicated that, generally, a common characteristic distinctively marks Iranian economic directions in Syria, which is the success in concluding agreements but failing to materialize them, due to three main factors: Russian competition, the impact of western sanctions, and Syria’s weak economy.

The level of Russian-Iranian competition in Syria is among the most influential factors affecting Iran’s positioning within the Syrian economic sectors and its future.

The study explained that Syria’s allies, Russia and Iran, engage in a competition over influence and war spoils, apparent from their targeting of the same economic sectors, instead of coordinating their acquisitions.

The balance of economic control tips in favor of Russia, as noted in numerous sectors, where the Russians “prevail,” according to the study, and vice versa, where the weak Russian economic intervention gives Iranians a significant margin to intervene and control.

Renewable credit lines since 2013

At the beginning of August 2023, the local Athr Press site quoted sources described as “informed,” stating an agreement between Iran and the Syrian regime to sign a new phase for the Iranian-Syrian credit line, aiming to ensure the regular and periodic flow of oil imports.

The sources also mentioned that the agreement would secure two million barrels of oil monthly.

A credit line is a type of financial facilitation and concessional loans provided by banks and financial institutions, with a defined ceiling for the amount that can be drawn as long as repayment schedules are adhered to.

The credit line can be increased if its balance is exhausted by agreement between the parties, and in the Iranian-Syrian case, the concept differs, as the Syrian regime lacks the financial capacity to meet its debts.

The first credit line opened by Iran to Syria was in 2013 with a value of one billion dollars at concessional interest rates, followed by another line worth three billion dollars to fund the country’s oil requirements and derivatives. In 2015, a new credit line was opened worth one billion dollars, which was discontinued in 2019 without stating the reasons.