Enab Baladi Issue # 110– Sun, Mar. 30, 2014

Muhammad Husam Helmi

Syrian residents in Britain have recently been at risk of closing their bank accounts; a number of Syrian clients have been receiving letters informing them about the banks’ decisions that their accounts will soon be liquidated and closed. The decision was made under the pretext of being “customer with connections to sanctioned countries” as the statement in the sent letters stated.

Enab Baladi got a copy of one of the letters sent to a Syrian resident in the UK by HSBC Bank. It states that “our record show that you are a resident in a country that is subject to financial sanction restrictions” and “due to the increased requirements for compliance with international obligations concerning payments to and from sanctioned countries, we have taken the decision to close the above account(S)”

The HSBC Banks has previously closed several accounts of Syrian people, according to Amina, a Syrian citizen resident of London. Master’s-degree holder Amina confirmed that the bank has closed her account three months ago without any advance notice.

Amina says she was neither corresponded nor notified about the bank’s decision nor was she given the time to make alternative banking arrangements; consequently, it took her two months to manage to open another account with Halifax Bank.

Ahmad. H, a Syrian student who lives in London for his doctorate studies in Economics, received a similar letter from HSBC Bank last month. The letter was meant to inform him about the bank’s decision of closing his account without giving any clear reasons for that. He said, he visited the bank branch twice to get an answer to “why closing” question, yet he never got it.

Ahmad contacted the bank’s managers, providing them with documents that prove the fact that he is a student who does not make any make any money transfers to or from Syria, thus he was able to convince the bank to reverse the decision of closure.

HSBC is not the only bank that has been taking such measures of closing accounts of UK residents of Syrian nationality. Other banks such as Lloyds adopted same practices.

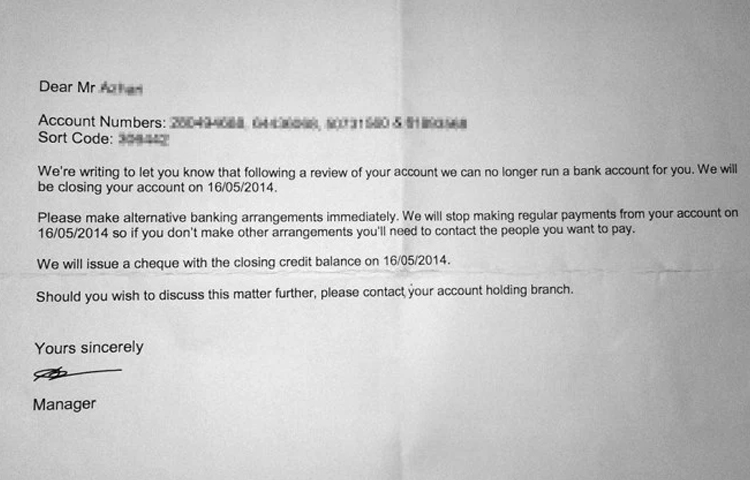

Muhammad received a letter sent by Lloyds Bank informing him that the bank has no longer the willingness to run a bank account for him, and that his account will be closed on 16/05/2014. The bank suggested that Muhammad should make “alternative banking arrangements immediately” in order to have a new account to transfer his money to, as the bank (Lloyds) will terminate all financial operations and “stop making regular payments” from the account on the assigned date.

The letter sent to Muhammad also referred him to his “account holding branch” in case he wanted to “discuss the matter further”; however, upon visiting the branch Muhammad was not given any reason for the decision. According to Muhammad, the employee’s only reply was “the bank has the right to close any of its client’s accounts”.

In co-operation with the Syrian Assembly in Manchester and the Human Rights organization, a group of Syrian activists in the UK are currently organizing a campaign against the British banks that close Syrians’ accounts. The campaign is aimed at shedding light on this issue and raising the media’s awareness about it in order to expose the practices of such banks that take these measures against clients who have the Syrian nationality.

The campaigns’ organizers are also documenting all cases of banks harassing or threatening Syrians to close their accounts; the campaign’s team is expected to “issue a statement that exposes the practices of British banks against the Syrians” within the coming weeks.

Translated by: Rahaf Al Abbar